What is the meaning and definition of fiscal quarter ? The following is the full explanation.In the financial world, the fiscal quarter , also known as Q1, Q2, Q3, Q4, is a term that refers to a quarterly period. One year, which consists of 12 months will consist of 4 parts, each of which lasts for 3 months. In a company, a fiscal quarter will be used as the basis for making financial reports and dividend distribution.

One fiscal quarter is equal to a quarter of a year or three months. Q stands for quarter. Q1 is also referred to as the first quarter, Q2 as the second quarter, Q3 as the third quarter, and Q4 as the fourth quarter. Most companies use quarterly basis in making financial statements and dividend distribution.

In general, this quarter division is based on calendar. Thus, the division of Q1, Q2, Q3 and Q4 by default becomes:

- Q1: January, February and March

- Q2: April, May and June

- Q3: July, August and September

- Q4: October, November and December

Most companies will use quarterly standard division as in the division above. However, not all companies implement this. Some of them have their own quarter division system based on their respective calendars. This is certainly based on each consideration according to the needs and business of the company.

Use of Fiscal Quarter

As mentioned earlier, quarter division plays a big role especially in the financial statements and dividends distribution of the company. One quarter is usually used as an accounting period or the preparation of the company’s financial statements.

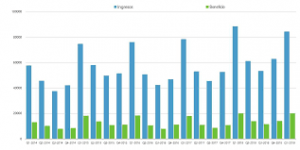

Company reports are usually made quarterly so that trends can be seen and compared with other quarters in one particular year or in a fiscal year. Usually, this analysis will be needed by internal companies, investors, analysts, and other related parties.

This analysis is also usually done by comparing the company’s performance in the same quarter in different years. For example analyzing product sales in the first quarter in 2017 and 2018. Usually, this analysis is done because in the same quarter, usually the same trend will occur. For example, construction companies will benefit more in the first quarter. It could also be in other companies, for example a clothing company will benefit a lot in the last quarter or fourth quarter.

This analysis can also be used to anticipate the decline in sales trends. For example, if a company in the second quarter usually experiences a decrease in sales. So, in the following year, the company will also anticipate a downward trend in sales in the second quarter. The company must think of a strategy to overcome this before entering the second quarter.

Fiscal Quarter Report

The company’s financial statements are usually made based on the fiscal quarter , so this report is made four times a year. This report is usually made and submitted to investors. This quarterly financial report will greatly help investors to analyze the company’s condition. This will affect investors’ decisions and the steps they will take in the future.

Every quarterly financial report will greatly affect the company’s stock price. If the company’s condition in the quarter is good, then the company’s stock price will rise. Conversely, if the condition of the company goes down or worsens, then the company’s share price will also go down.

All publicly traded companies are required to make and report finances divided quarterly. While the annual report or year-end company report contains more detailed reports including audit results, presentations, and other additional information.

Limitation on Fiscal Quarter Use

Although widely applied and considered to have many advantages and advantages, the use of the fiscal quarter also has usage restrictions. Some companies even have doubts about the importance of the fiscal quarter system .

Warren Buffet, CEO of Berkshire Hathaway (BRK) and Jamie Dimon, CEO of JP Morgan Chase (JPM) even said that the fiscal quarter system creates too much pressure and stress. The company is considered to be very pressured to always make quarterly reports that are satisfying for investors rather than making plans that are useful for the company’s long term.

Some people also have the opinion that the semi-annual system will be more useful than the fiscal quarter system in preparing company financial statements.

Non Standard Quarter Distribution

The division of one year into four quarters is usually done according to the standard sequence in the calendar as previously mentioned. However, apparently not all companies apply the standard quarter division as they do. Some companies apply non-standard quarterly distribution.

Examples of companies that implement this system are Walmart, which has the first quarter in February, March and April. Another example is Apple Inc., which has its first quarter in October, November and December. Microsoft Corporation also has a non-standard first quarter in July, August and September.

Not only companies, a country may also have non-standard quarter divisions, although most countries choose to use standard quarter divisions. An example is the United States, which has the first quarter of October, November and December.

The use of non-standard quarter is indeed not chosen haphazardly, but through certain considerations. For example, consider putting the last quarter in when business trends are the busiest. In this way, the company can make financial reports after the busiest time of the year. This will make it easier for investors and analysts to make decisions regarding plans for the following year.